Property and inheritance matters in India can be intricate, and for Non-Resident Indians (NRIs), the complexities are often amplified by geographical distance, differing legal systems, and a lack of on-ground presence. One crucial legal process that often arises in inheritance is Probate. Understanding whether you need a probate lawyer is paramount for NRIs to ensure a smooth and legally sound transfer of inherited assets..

What is Probate in India?

As per Section 2(f) of the Indian Succession Act, 1925, Probate means “the copy of a Will certified under the seal of a court of competent jurisdiction with a grant of administration to the estate of the testator.”

In simpler terms, Probate is a legal process by which a competent court officially validates a Will and grants legal authority to the Executor (the person named in the Will to manage the estate) to administer the deceased person’s assets according to the Will’s instructions. It’s essentially a judicial confirmation of the Will’s authenticity and the Executor’s right to represent the deceased’s estate.

When is Probate Mandatory in India? (Crucial for NRIs)

While a Will is a legal document even without probate, the grant of probate establishes the genuineness of the Will definitively and legally empowers the Executor. Crucially, probate is mandatory only in specific circumstances in India, primarily depending on the deceased’s religious background, geographical location of the Will’s execution, and the type of property involved.

Probate is MANDATORY in the following specific scenarios, as per Section 213 read with Section 57 of the Indian Succession Act, 1925:

- For Wills executed by Hindus, Sikhs, Jains, or Buddhists:

- Within the territorial limits of the High Courts of Delhi, Mumbai (formerly Bombay), Kolkata (formerly Calcutta), or Chennai (formerly Madras).

- This rule applies even if the immovable property mentioned in the Will is located outside these cities, as long as the Will itself was made within these specific municipal limits.

- For Wills executed outside these specific territories, but relate to immovable property situated within the territorial limits of the High Courts of Delhi, Mumbai, Kolkata, or Chennai.

- For Wills made by Christians anywhere in India. (Note: For Christians, Section 213 applies more broadly, making probate or Letters of Administration mandatory in most cases for the Will to have effect, irrespective of location).

What does this mean for NRIs? If your deceased loved one (a Hindu, Sikh, Jain, or Buddhist) made a Will while residing in Delhi, Mumbai, Kolkata, or Chennai, or if their Will (regardless of where it was made) deals with immovable property located within these cities, probate is legally required to effectuate the Will. Without it, the Will may not have legal sanctity or binding force to transfer assets, especially immovable property.

When is Probate NOT Mandatory? In all other cases, probate is optional or not strictly mandatory for the Will to be effective. For example:

- A Will made by a Hindu in Punjab, relating to property in Punjab.

- A Will made by a Muslim (as Muslim law has its own inheritance rules not governed by the Indian Succession Act for this purpose).

- For movable properties (like bank accounts, shares, FDs) where there is a nominee, probate may often be bypassed by banks/financial institutions based on their internal policies and other documents like a Death Certificate, Affidavit, and Indemnity Bond. However, for significant amounts or if there are disputes, they may still insist on probate or a Succession Certificate.

The Probate Process in India (for NRIs)

The process typically involves the following steps:

- Preparation of Petition: The Executor named in the Will (or a beneficiary, if no Executor is named or willing to act, who would then apply for Letters of Administration with the Will annexed) files a Petition for Probate in the appropriate court.

- Jurisdiction: The petition is usually filed in the District Court or the High Court (which has concurrent jurisdiction) having jurisdiction over where the deceased resided or where the immovable property is situated. For properties in Delhi, this would be the Delhi High Court or the respective District Court.

- Documents Required: Original Will, Death Certificate of the deceased, Affidavit of assets (detailing all movable and immovable properties and their valuation), Identity and address proofs of the Executor and witnesses, and supporting documents for the properties.

- Court Fees: A significant aspect of probate is the court fee payable, which is typically a percentage of the value of the estate as per the High Court Rules of the respective state. This fee varies widely across states. In Delhi, the court fee can be substantial for high-value estates.

- Notice to Next of Kin: The court issues notices to the legal heirs (next of kin) of the deceased, inviting objections to the grant of probate. This is to ensure that no one with a legitimate claim is deprived of their right without due process.

- Public Notice/Publication: A public notice is often published in leading newspapers (English and vernacular) inviting objections from the general public to the grant of probate within a specified period (e.g., 30 days).

- No Objection / Contested Case:

- No Objection: If no objections are received, and the court is satisfied with the authenticity of the Will, probate is usually granted without delay.

- Contested Case: If objections are raised, the probate petition is converted into a regular civil suit. The parties will lead evidence, argue the matter, and the court will pass a judgment based on the evidence presented. This can significantly prolong the process.

- Grant of Probate: Once the court is satisfied, it issues the “Grant of Probate” under its seal, officially validating the Will and empowering the Executor.

- Distribution of Assets: With the probate in hand, the Executor can now legally manage the deceased’s estate, pay off debts, and distribute the remaining assets to the beneficiaries as per the Will.

Challenges NRIs Face in Probate Cases

NRIs often encounter unique difficulties when dealing with probate in India:

- Geographical Distance: Being physically away makes it challenging to attend court hearings, sign documents, or coordinate with local authorities.

- Lack of Local Knowledge: Understanding India’s diverse legal landscape, court procedures, and bureaucratic requirements can be daunting.

- Documentation: Gathering original documents, especially if they are old or not properly maintained, can be a hurdle.

- Language Barriers: Court proceedings and many legal documents are in local languages.

- Time Commitment: Probate can be a lengthy process (ranging from a few months to several years, especially if contested), which is difficult for NRIs to manage.

- Family Disputes: Disputes among family members over the Will’s validity or property distribution can turn a straightforward probate into a prolonged legal battle.

- Tax Implications: NRIs need to understand the tax implications of inherited assets, including potential capital gains tax if the property is sold.

Do You Need a Probate Lawyer? The Indispensable Role for NRIs

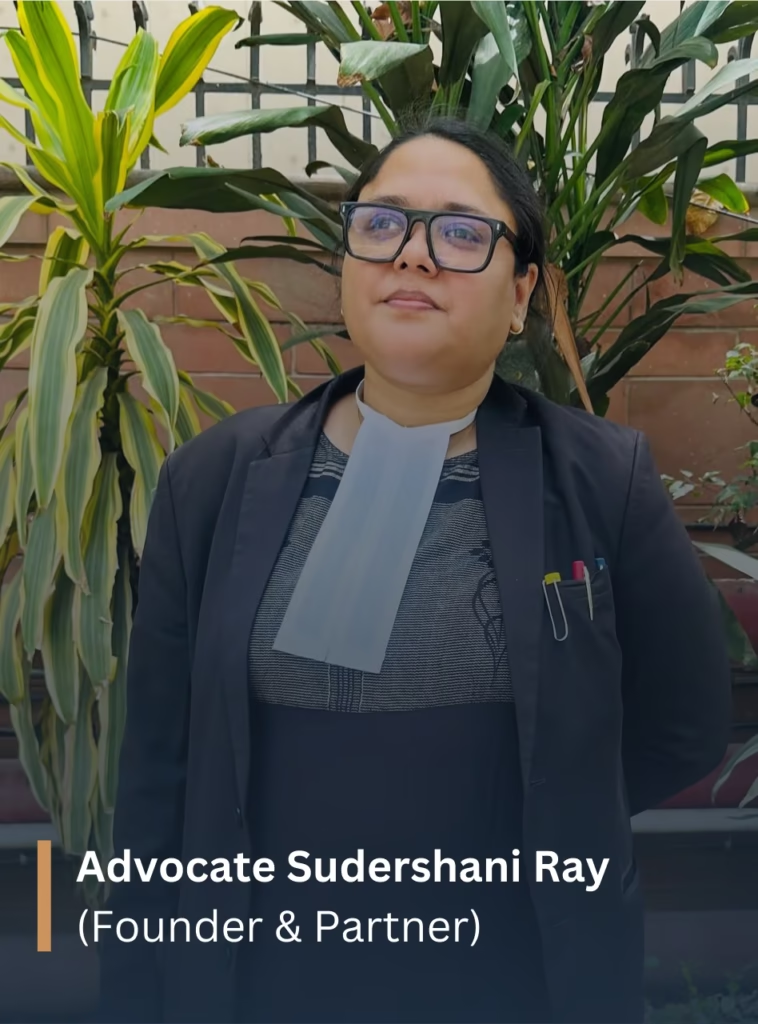

For an NRI, engaging a specialized probate lawyer in India is not just advisable, it’s almost a necessity. Here’s why a legal expert from VantaLegal is crucial:

- Expert Assessment & Strategy: A probate lawyer will thoroughly review the Will, assess its validity, determine if probate is mandatory in your specific case (considering your location, the deceased’s residence, and property location), and advise on the most strategic legal path.

- Document Management: They will guide you in gathering all necessary documents, ensure they are properly authenticated (especially if documents are from abroad), and prepare the exhaustive list of assets and their valuations required by the court.

- Drafting & Filing: Lawyers meticulously draft the probate petition, affidavits, and all supporting applications in compliance with the Code of Civil Procedure and the Indian Succession Act. They handle the filing process in the correct jurisdictional court in Delhi.

- Court Representation: Your lawyer will represent you in court, attend all hearings, respond to court queries, present arguments, and manage any objections raised. This minimizes your need to travel to India.

- Navigating Objections: If the Will is contested, a probate lawyer is crucial for defending its validity, collecting evidence, cross-examining opposing witnesses, and navigating the complexities of a contested probate suit.

- Liaison with Authorities: They will liaise with the court registry, public notice publishers, and other relevant departments, streamlining the bureaucratic process.

- Power of Attorney (PoA) Assistance: If you cannot be physically present, your lawyer can guide you on executing a legally sound Power of Attorney to empower a trusted individual (often the lawyer themselves or a family member) to act on your behalf in India.

- Post-Probate Formalities: Once probate is granted, the lawyer can assist the Executor in the subsequent steps of asset distribution, property mutation, and other transfer formalities.

- Tax Guidance: While not tax advisors, they can often guide you on the general tax implications and recommend relevant tax consultants.

Succession Certificate vs. Letters of Administration vs. Probate

It’s important for NRIs to understand the distinctions:

- Probate: Granted when there is a Will, validating the Will and empowering the Executor to administer all movable and immovable property mentioned in it.

- Letters of Administration: Granted when there is a Will but no Executor is named, or the named Executor is unwilling/unable to act. It gives legal authority to an Administrator (usually a legal heir) to manage the estate according to the Will. It’s also necessary when a person dies intestate (without a Will), and there’s immovable property or complex movable assets.

- Succession Certificate: Granted when a person dies intestate (without a Will). It is primarily for claiming movable assets like debts and securities (e.g., bank deposits, shares, provident fund). It does not establish title to immovable property.

Secure Your Inheritance with VantaLegal

For NRIs, navigating the probate process in India can be a significant undertaking. The mandatory nature of probate in cities like Delhi, Mumbai, Kolkata, and Chennai, coupled with the inherent complexities of legal proceedings and the challenges of managing affairs from abroad, makes professional legal assistance indispensable.

At VantaLegal, our sharp, trustworthy, and tech-oriented lawyers specialize in inheritance laws and probate matters for NRIs. We work tirelessly to simplify the process for you, ensuring your deceased loved one’s final wishes are honored and your inherited assets are secured legally and efficiently.

Don’t let distance or legal intricacies become a barrier to your rightful inheritance. Contact VantaLegal today for expert advice and robust legal support on all your probate needs in India.